Publication featured in City AM and The Guardian.

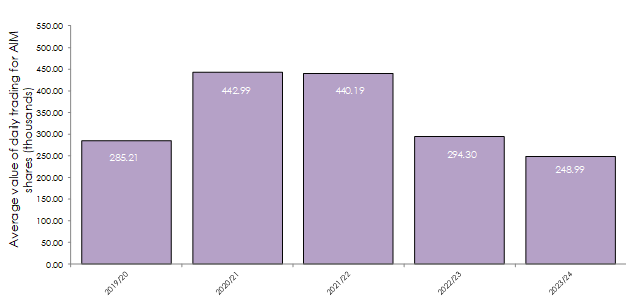

Companies listed on the UK’s Alternative Investment Market (AIM) have seen the average value of the daily trading of shares fall 15% to just £248,990 in 2023/24 down from £294,300 in the previous year (year-end 28 February).

Colin Wright, UHY UK Group Chairman and Partner, says the decrease in liquidity of AIM is partly being driven by UK investors increasingly trading in overseas companies, especially tech stocks such as Nvidia and other members of the “Magnificent Seven”.

AIM has also suffered from the broader drop in liquidity that followed the Covid period peak in stock market trading. That reduction in trading volumes has impacted major stock markets across the US and Europe*.

"Whilst AIM remains a key trading platform for many investors, the recent drop in its liquidity shows that more needs to be done to help keep UK stock markets as attractive trading and investing venues."

Markets benefit from high liquidity as it should allow investors to trade stocks without having an outsized impact on the price of that stock. As a result, institutional investors can build up a substantial holding in a company over time or exit a position without causing a big fluctuation in a company’s share price.

As high liquidity is attractive to investors, investment-grade companies are more likely to be encouraged to list on a market with high liquidity. Adding more of these companies would help further improve AIM’s reputation amongst institutional investors.

The average value of the daily trading of AIM has fallen by 44% from a recent high of £442,996 in 2021/22 (year end 28 February). This fall has partly been driven by a drop in the share prices and share trading of some of AIM’s flagship companies, such as Boohoo and Fever Tree. The share price of online fashion retailer Boohoo fell by 89%, from £337.50 to £35.99, whilst the share price of drinks manufacturer Fever Tree fell by 47%, from £2,260 to £1,197.

In recent weeks, the lack of AIM liquidity has also been cited by companies announcing their intention to delist from the market. This impacts companies as low liquidity means their share price can become more volatile, making it more difficult to raise finance on AIM.

Colin Wright says: “In the wake of the pandemic, AIM had a standout year, with liquidity reaching some of the highest levels ever recorded in 2020/21. Now trading volumes is reverting to their pre-pandemic levels.”

“It's ten years since stamp duty on AIM shares was scrapped – the Government should be looking at what other major initiatives it can take to encourage investment in AIM companies, such as lower CGT rates.”

“It is essential that AIM maintains its draw to listed companies. Having a healthy stream of IPOs into the market is one way that the London Stock Exchange can ensure that AIM remains a key trading platform to listed companies.”

“The London Stock Exchange could also look at renewed marketing campaigns to highlight the key benefits offered by AIM to investment grade companies and to investors.”

In the recent Budget, the Government announced a new tax-free £5,000 annual ISA allowance, in addition to the existing £20,000 allowance, dedicated to investments in UK companies. It is expected to be available to investments in AIM.

Adds Colin Wright: “Should the proposed ISA go ahead, this could act as a helpful boost to AIMs liquidity, helping to keep more UK listed companies on the market.”

AIM hit by further fall in average value of daily trading - liquidity dropped 15.4% in past year

*Source: Société Générale - Measure of Stocks with a six-month average daily trading volume above $1m by region (indexed, excluding REITS & investment trusts).