Publication featured in: The Times, City AM and Investor's Chronicle

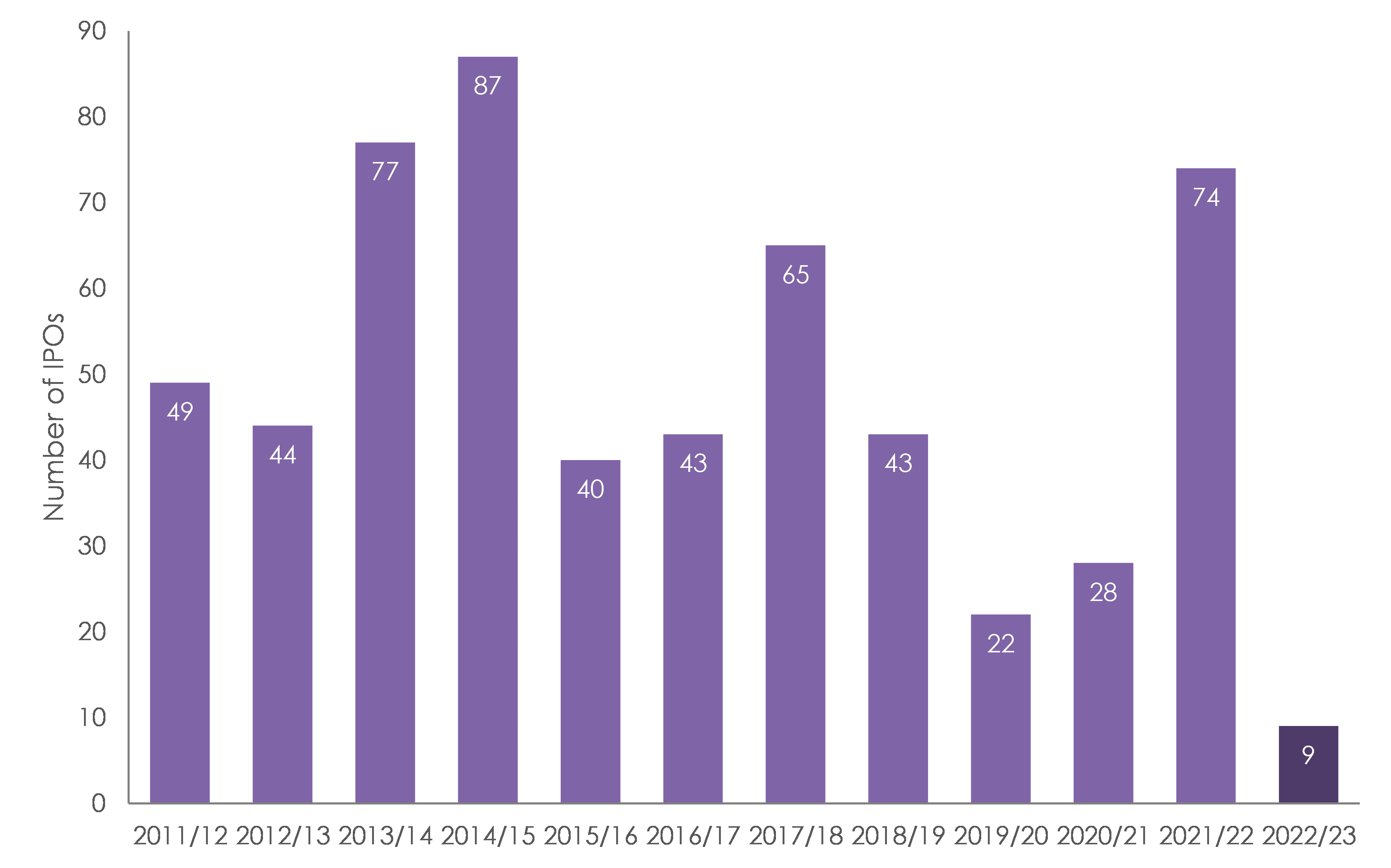

London’s AIM market saw only nine new company listings in the past year*, a record low for the market and an 88% decrease on the 74 listings in the previous year, says UHY Hacker Young, the national accountancy group.

Fewer new listings has led to a 97% fall in funds raised in IPOs, from £1.44 billion in 2021/22, to just £46 million this year.

Since it was launched in June 1995, AIM has delivered an average of 138 IPOs per year, fifteenfold more than the nine in the past year. The previous record low was in 2019/20, which saw 22 IPOs during lockdown conditions. In the aftermath of the credit crunch in 2009/10, there were 47 IPOs.

Investors have become more risk averse as interest rates have risen and are now markedly less interested in smaller, high-growth, higher-risk investments. This has hit equity markets overall, but particularly growth markets like AIM.

The past 12 months have seen tumultuous market conditions.

It has been the annus horribilis for speculative technology companies and the annus horribilis for AIM IPOs and investment banking community that works in that area.

Volatile market conditions make it very hard to get an AIM IPO away. The last year has seen more than enough shocks to disturb the market from Ukraine, to runaway inflation, to Credit Suisse.

Over the last year UK investors have experienced a bloodbath for growth shares and larger more mature dividend paying companies are now more in demand. With interest rates increasing, growth stalling and continued political uncertainties, investors want stable cash flows over speculative future growth.

Many companies will have discussed at length with their Nomad whether to start their investor roadshow, concluding that it’s best to wait for a longer period of lower volatility in the market before pressing on with their IPO plans.

New listings on AIM have reached a record low

*Year end of March 27 2023