Publications featured in include: Accountancy Today

- Corporation tax refunds from HMRC expected to soar as Covid-19 hits profits

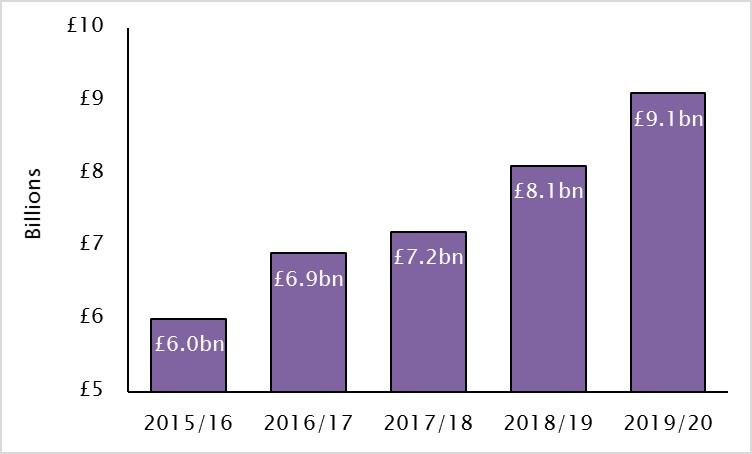

UK businesses overpaid at least £9.1bn in corporation tax in the last year*, up 12.4% from £8.1bn the previous year, our research shows.

This figure is going to be dwarfed this year as the lockdown recession and slumping profits means that UK businesses will have overpaid corporation tax on an even grander scale.

Many large businesses are required to pay corporation tax based on forecast profits for the upcoming year, meaning they have overpaid taxes if profits fall unexpectedly. A large number of these businesses will have made estimates of their profits prior to lockdown and the economic crash and overpaid significantly as a result.

In some cases, businesses may be unaware that any losses they generate this year can be carried back to reduce the tax liabilities of the previous year, i.e. they would have overpaid corporation tax and they should be claiming a refund.

Unlike PAYE income tax, there is no system for overpayments to be refunded automatically. If they fail to carry back the losses and request a refund in time, HMRC could hold onto their money.

Nikhil Oza, corporate tax director at our London office, says: “Even a relatively mild slump in economic growth means that many companies will have missed their profit targets and have overpaid corporation tax – the Covid crash is likely to see them skyrocket.”

“Businesses need to be especially on the ball with requesting a refund where they believe they have overpaid based on the current year’s estimated profits. The taxman won’t chase them to give it back.”

“Unfortunately, the application process for requesting refunds where the tax return has not yet been submitted is rather tortuous and it may be easier to simply file the tax return.”

“Rather than waiting until the tax return deadline, which is 12 months after the company’s year-end, businesses might want to file this year’s tax return as soon as possible. This speeds up the process of reclaiming any overpayment and generating a cashflow advantage, which is likely to be particularly valuable as they try to bounce back from Covid.”

Corporation tax refunded to businesses due to overpayment jumps 12.4% to £9.1bn in the last year