Publication featured in: The Daily Telegraph

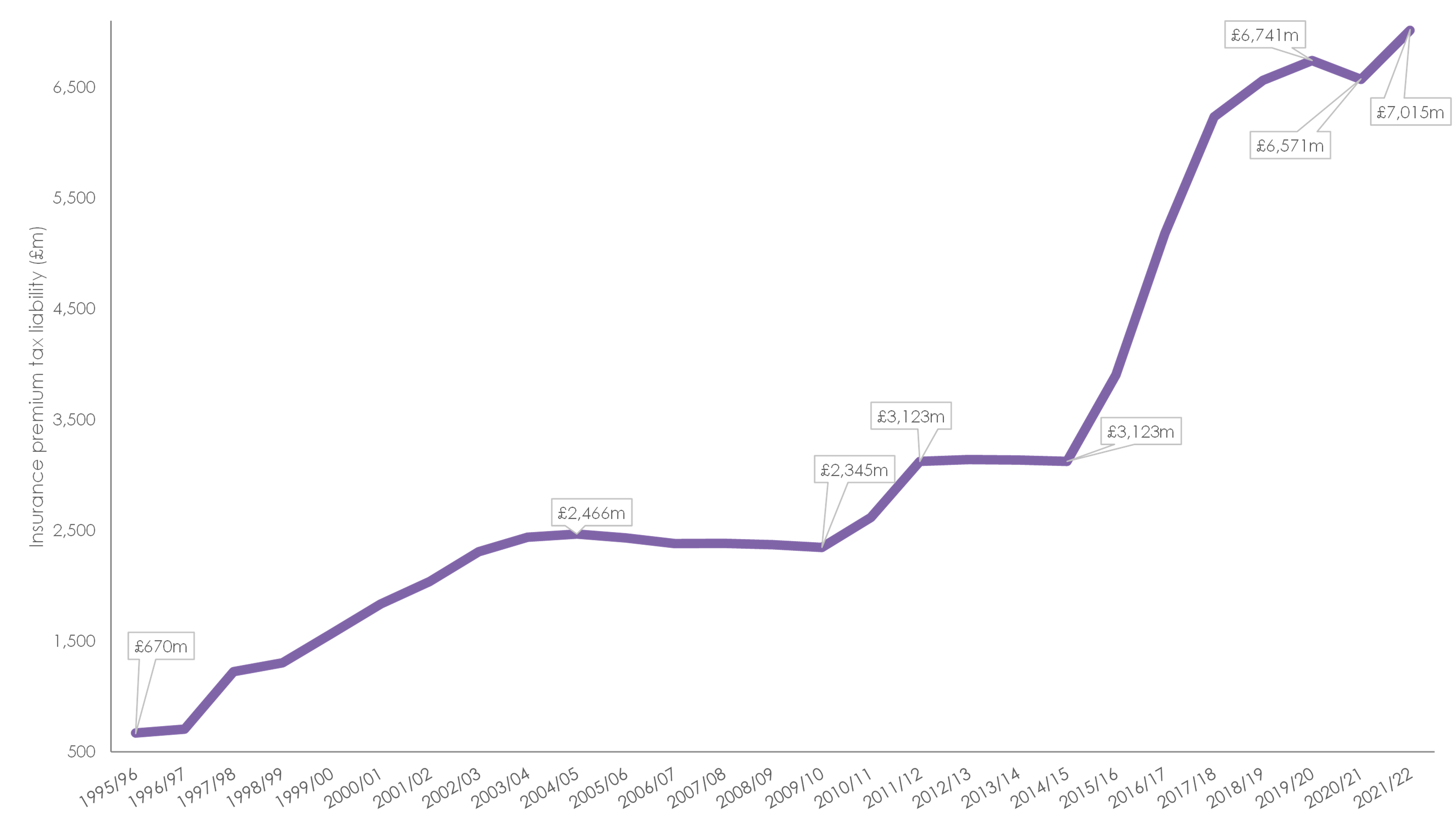

The cost of Insurance Premium Tax (IPT) – a so-called ‘stealth tax’ levied on insurance premiums – has now increased 124% over the past ten years, from £3.1bn in 2012 to £7bn in 2022.

IPT is a tax that is paid by consumers and businesses on almost all insurance policies they buy. The cost of IPT is added on to the cost of the insurance policy by the insurer, meaning most consumers will never know how much IPT costs them – or even that they are paying it at all.

IPT is even levied on insurance policies that consumers are forced to buy – such as car insurance and buildings & contents insurance for people who own a mortgaged property.

Since its creation in 1994, the IPT rate has repeatedly climbed from just 2.5% to its current rate of 12%. An even higher rate of 20% is charged on some types of policies, including travel insurance and electrical appliance insurance.

As the number of insurance policies people take out continues to rise, households are paying more and more in IPT without even realising it.

Tax on insurance is an invisible cost of living burden that many people are completely unaware of.

Households are being hit with a double whammy of paying for insurance, as well as the tax on top of it – all at a time when budgets are already being stretched to the limit.

The number of insurance policies people take out has risen sharply in recent years – pet and mobile phone insurance are just a couple of examples. All of those new policies mean even more income for the taxman.

Cost of Insurance Premium Tax tops £7bn for the first time

* Year end May 31 2022. Source: HMRC