Publications featured in include: Financial Times, The Daily Telegraph, The Guardian, Daily Express, Sky Sports, The i, International Investor, The Mirror, Daily Star, City AM, Daily Mail, Accountancy Today, Accountancy Daily, International Investment, Professional Adviser, Brinkwire and Spears.

- 246 footballers now under investigation – almost equivalent to ten Premier League squads

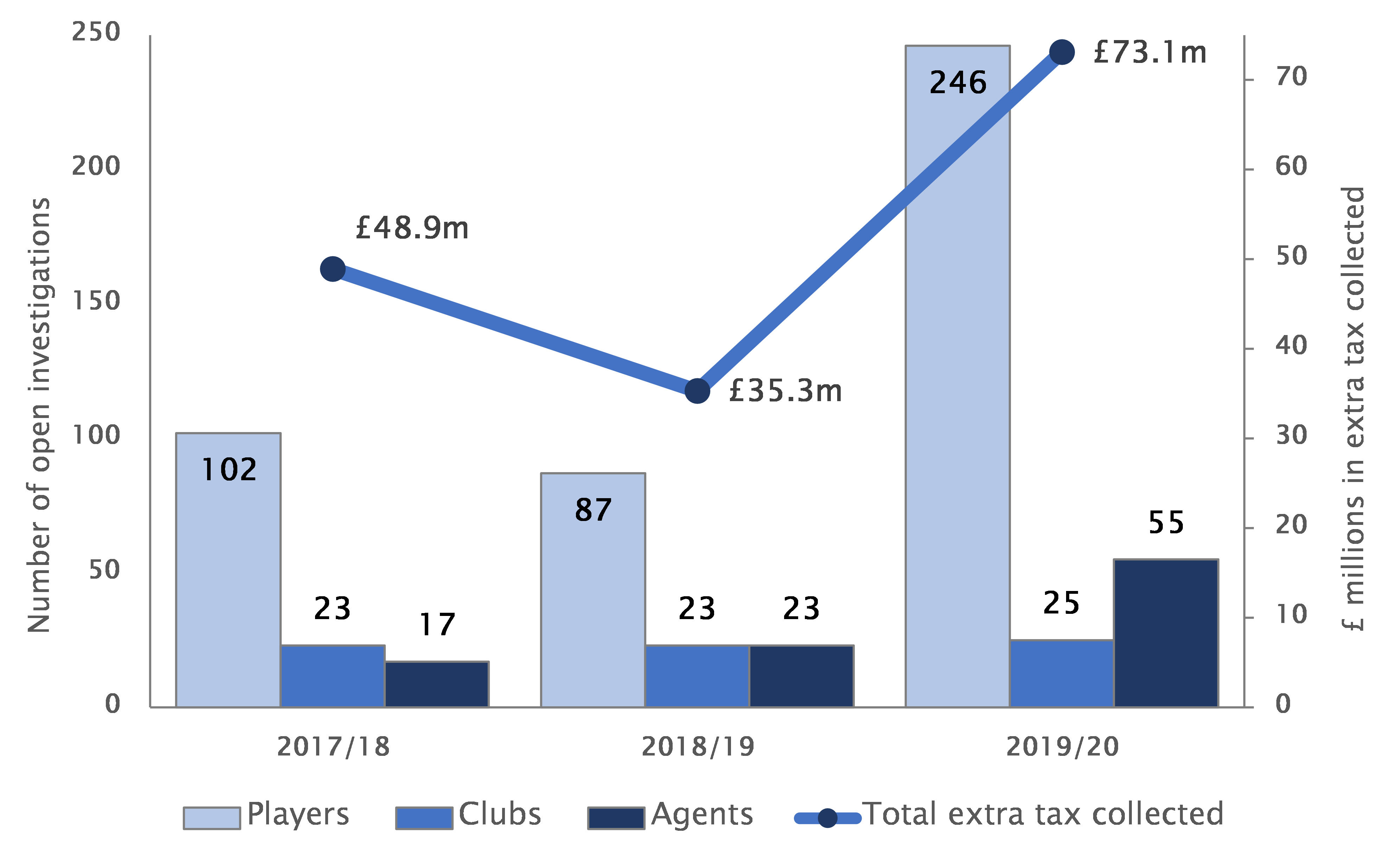

HMRC investigations of footballers have almost trebled from 87 to 246 in just the last year* as the taxman targets ‘image rights’ deals that it believes are being used to avoid tax, our research shows.

The number of players under investigation is now almost equivalent to ten 25-man Premier League squads.

HMRC is targeting what it sees as over-aggressive use of ‘image rights’ deals, in which players are paid additional money on top of their salary for use of their image by the team in advertising and endorsements. This money is commonly paid to a company set up by the player for this purpose and is only taxed at the 19% corporation tax rate, rather than the 45% income tax rate paid by high earners.

HMRC believes many of these deals amount to tax avoidance, particularly in cases where players who are not household names are paid a significant percentage of their compensation in image rights payments. In some cases image rights companies are based offshore, reducing tax paid even further.

Elliot Buss, partner at our Newport office says: “HMRC believes that lots of lesser-known footballers are effectively avoiding tax by getting paid huge sums for image rights that HMRC views as overpriced.”

“The image rights of the likes of Paul Pogba and Mohamed Salah are undoubtedly worth millions of pounds a year. However, if you are second-choice left back in the Championship getting paid a great deal in image rights payments, then this is likely to trigger an investigation by the taxman. You may have to make a robust argument to HMRC to show how the value of the image rights has been arrived at.”

Football agents also in firing line for HMRC

Football agents are also in the firing line for HMRC, with the number of investigations of agents more than doubling from 23 in 2018/19 to 55 in 2019/20.

HMRC is keen to uncover cases where agents’ fees from transfers – which are paid by players and can run to millions of pounds – are not declared correctly for tax purposes. The tax authority suspects that this is the case in many transfers.

Says Elliot Buss: “Despite having a very substantial income, many young footballers don’t get the advice they need when it comes to tax. Often they don’t realise they need to pay tax on the fees that the club pays the agent on behalf of the player when they sign a new contract. That frequently results in errors, investigations and hefty penalties.”

In addition, HMRC opened 25 investigations into football clubs in 2019/20, up from 23 in 2018/19.

The tax authority’s overall additional tax collected from investigations into professional football in 2019/20 was £73.1m, more than double the £35.3m collected a year earlier.

HMRC investigations of footballers jump sharply – equivalent of ten Premier League squads now facing inquiries